While driving back from a meeting, some talking heads on a radio show proclaimed that the biggest investment anyone will ever make is the purchase of their primary residence.

“Here we go again!” This thought process really gained steam in the run-up prior to the last bust. Who are these people? The biggest expense you will ever have apart from feeding your children and paying for your education is the cost of where you live.

Your primary residence is… where you live; and where you live could be anything from a hotel room night to night or a multi-generation family estate on endless of acres of land. Neither of those two examples or any other classification of primary residence in between is an investment. It is an expense.

The concept behind real estate investment is generally to provide a return either by appreciation or income. Primary residences are an expected expense usually paid over a period of time, monthly, annually or in some other well-defined term.

Sure, at the end of a mortgage you have gained an asset fully paid for and ready for whatever comes next, but the idea that it was an investment implies a business thought process of numbers, risk and reward.

Choosing a primary residence does have all of the numbers, risks and rewards as part of the process, but with additional criterion of emotion, passion, excitement and retreat that are not measured in dollar terms. How can a family gathering, the birthday celebration or caring for the ill at home be measured in investment terms?

Any of the following thoughts can bring contentment to homeowners (as well as renters)  while having no bearing on the thinking of the investor class: My neighbors are really nice. The kids love to plant flowers here at the front door. This deck has great views. Nothing better than sitting here on Sunday morning having a cup of coffee. Should we clean out the garage?

while having no bearing on the thinking of the investor class: My neighbors are really nice. The kids love to plant flowers here at the front door. This deck has great views. Nothing better than sitting here on Sunday morning having a cup of coffee. Should we clean out the garage?

The satisfaction coming from a where you live can be measured, but dollar value is certainly not the be all and end all of that measurement. The ‘investment’ of time and community is something that memories will give value to in reflection as well as daily emotional well being. These concepts are the drivers for those looking to be ‘happy’ in their living arrangements.

Living under the stress of aggressive mortgage payments that ‘keep you poor’ is no fun, neither is the worry of wondering when the landlord wants to up the rent or ask you to leave. What is the purpose of living in an “investment” condominium downtown, if you always wanted to live at the beach? Will your ‘investment’ bring you happiness?

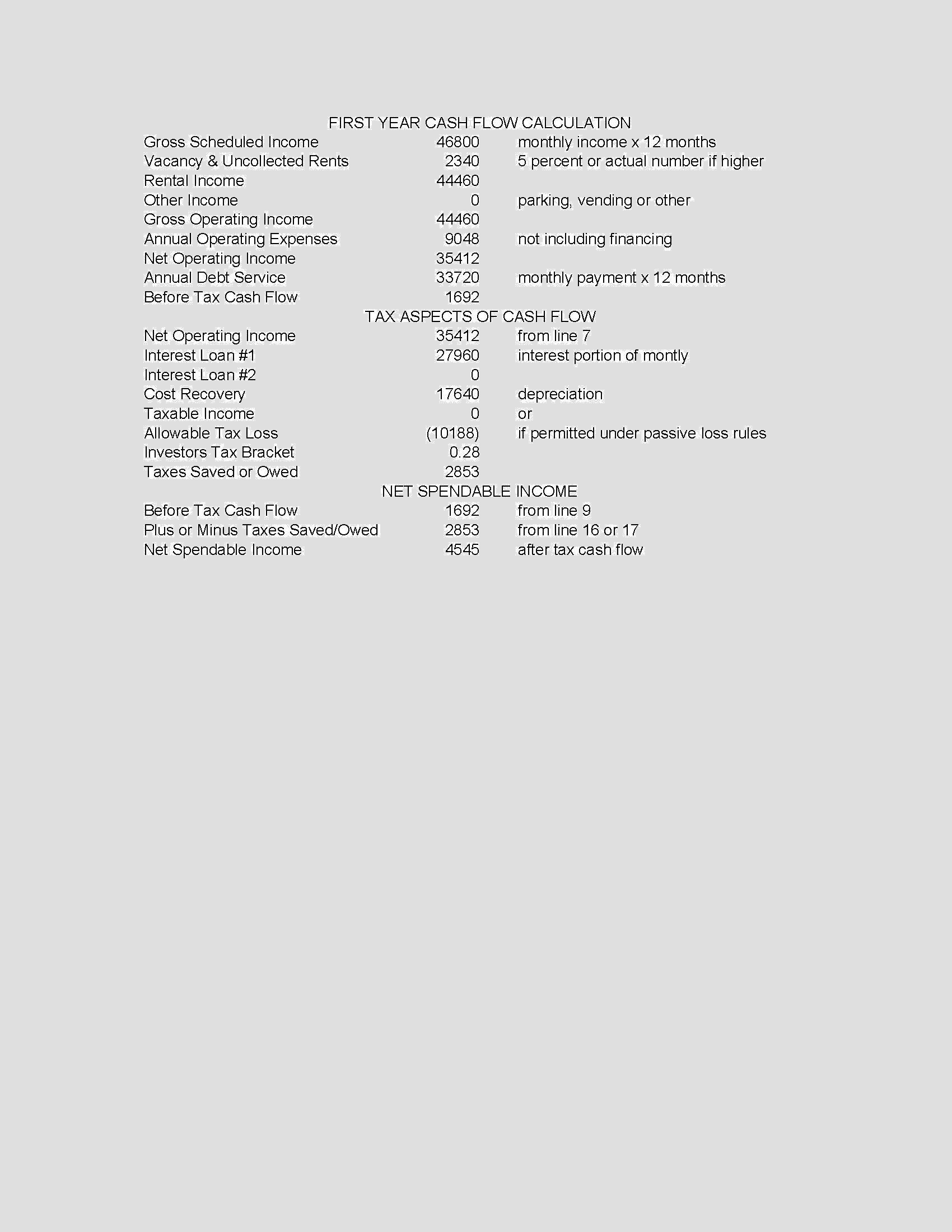

20 minutes of solid number crunching will give any well-versed investor the answer to whether the property under consideration is worth the effort to pursue. Advantageous locations with supporting social amenities, acquisition cost and return on investment (ROI) are the focus. No “wow, I love this place”. No “I wonder if the neighbors kids will play well with mine”. And no coffee on the deck, just the numbers.

20 minutes of solid number crunching will give any well-versed investor the answer to whether the property under consideration is worth the effort to pursue. Advantageous locations with supporting social amenities, acquisition cost and return on investment (ROI) are the focus. No “wow, I love this place”. No “I wonder if the neighbors kids will play well with mine”. And no coffee on the deck, just the numbers.

The number game is not lost to the homeowner with many solid economic advantages such as, Government subsidy on mortgage interest, Schedule A tax deductions and favorable capital gains treatment on the sale of a primary residence. However, the focus on ‘investment’ is ludicrous and rarely sincere once diving deeper in to the history.

It is not hard to find in causal conversation people who have owned their primary residence during the past number of economic cycles, up and down. No ‘paper’ gain or loss was realized when no sale was made. There was no investment strategy identified or fulfilled. Some were lucky enough to refinance their loan taking advantage of the low rates while others lost ground in the down turn finding themselves unable to refinance or worse losing their home. The events hidden behind most of these stories are usually ‘reactionary’.

What was the investment program of the couple when they bough their first house 35 years ago? That was before their children arrived, before the job changes, before the other homes were built on the street, before the boom and bust of the past decade. Improbable they were planning an exit strategy and more likely they were wondering how they were going to make their payments.

Individual homeowners and investors remain two distinct classes. When looking to provide stability and comfort, it is ‘good business’ to take a strong clinical look prior the purchase of a primary residence. Investing in real estate is a business not a place to live.