It all started when a client called after closing on a condominium unit with “just a few questions”. It is always a major bummer when the story gives the sinking feeling that it will only get worse as it progresses.

Managers are everywhere. They are at work, at the kids’ school, the town, at the store and at times even in the home. No problem when they are effective, kind and helpful, even when a situation arises that cannot be solved to your favor.

This story is not like that. The buyers buy. During the inspection process all the documentation for the condominium, a large complex, was made available for review during the inspection process. All the tenets in the documentation were acceptable to the buyers. Their attorney made review, their lender made review, both finding no objection.

When approaching the onsite manager’s office after the closing the now owner was looking for some simple information about window replacement part numbers or if they knew of any contractors that did that sort of thing at the complex.

What to do when a manager is obstructive, mean, a weirdo and a liar? That situation is not fun at all. It turns out that this manager was all of the above and more. According to the buyer wife, “a greasy, fat pig with his fly down” said that the owners were not allowed to change the windows, or flooring, or cabinets or any other thing without his permission. Egad!

Having run into a fair amount of ‘unhelpful’ souls the advice was to recheck the documentation and write a letter to the management company cc’d to the trustees of the condominium project asking for resolution. No such luck. The onsite manager only became an even bigger jerk.

Many might fold under that pressure. Thankfully the new owners having done their inspections, including all the condominium documentation, budget, financial statements and annual report were able to use their rights in ownership to remain steadfast in their understanding of what they could or could not do in the unit.

The replacement windows were the least of their problems. The brilliant manager/weirdo/whatever told the owners after seeing a contractors truck in front of the building that if they installed any new hard-surface flooring in an upstairs unit the he would have the right to enter the unit and have any installation removed (this contrary to all the documentation provided prior to purchase). He even went so far as to demand a new key to the unit so he might “check to see what is going on”.

Tenacious personalities can be rewarded when working methodically through a process with careful thought, documentation, planning and a good attitude. Additional letters had to be written to put the manager/weirdo/whatever on notice by way of the condominium trustees, the management company and the buyer’s attorney.

Thankfully there were no fireworks at the monthly trustee’s meeting where the buyers, strong evidence in hand were easily able to gain ‘official’ approval for any and all work to be done in their new unit, idiot be damned. The work was completed. The reports are it all looks beautiful.

So, what is the moral of the story? First, if at all possible avoid rectal pores, as they will always try to wreck a good day. Second, know what all that paperwork is about, it exists for a reason, and that reason is to protect the owners of the units. Third, knowledge is power. The power to decide, act (or not) is comforting when confronted by the imbecilic. Forth, management companies work for the condominium. They are contracted to serve the community to their best ability as specified within the charter. Hopefully the jerk was fired.

Opinions differ when canvasing owners of condominium units as to the satisfaction in ownership. There are all kinds of complexes, each having personality, each being run well or not. Time also can change the flavor in an association, with politics, ideas and the economy of the association challenged by outside influences.

Before buying into a communal form of ownership be sure that the community itself is solid. There are beautiful units everywhere, but it only takes one jerk (that you might have to see daily) to ruin the story.

The owner made a strong effort in time and money to gain permits allowing for the turbines to be reopened only to find that a total of 70 agencies would have to sanction the proposal, and even at that, the final governing agency would only issue a permit on an annual basis. Needless to say the project was not pursued.

The owner made a strong effort in time and money to gain permits allowing for the turbines to be reopened only to find that a total of 70 agencies would have to sanction the proposal, and even at that, the final governing agency would only issue a permit on an annual basis. Needless to say the project was not pursued. while having no bearing on the thinking of the investor class: My neighbors are really nice. The kids love to plant flowers here at the front door. This deck has great views. Nothing better than sitting here on Sunday morning having a cup of coffee. Should we clean out the garage?

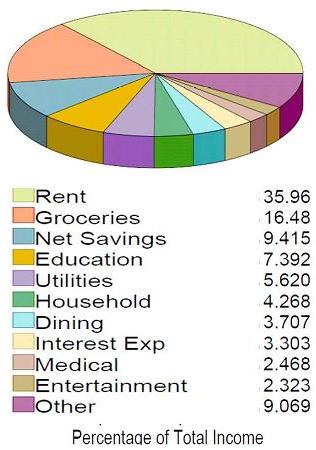

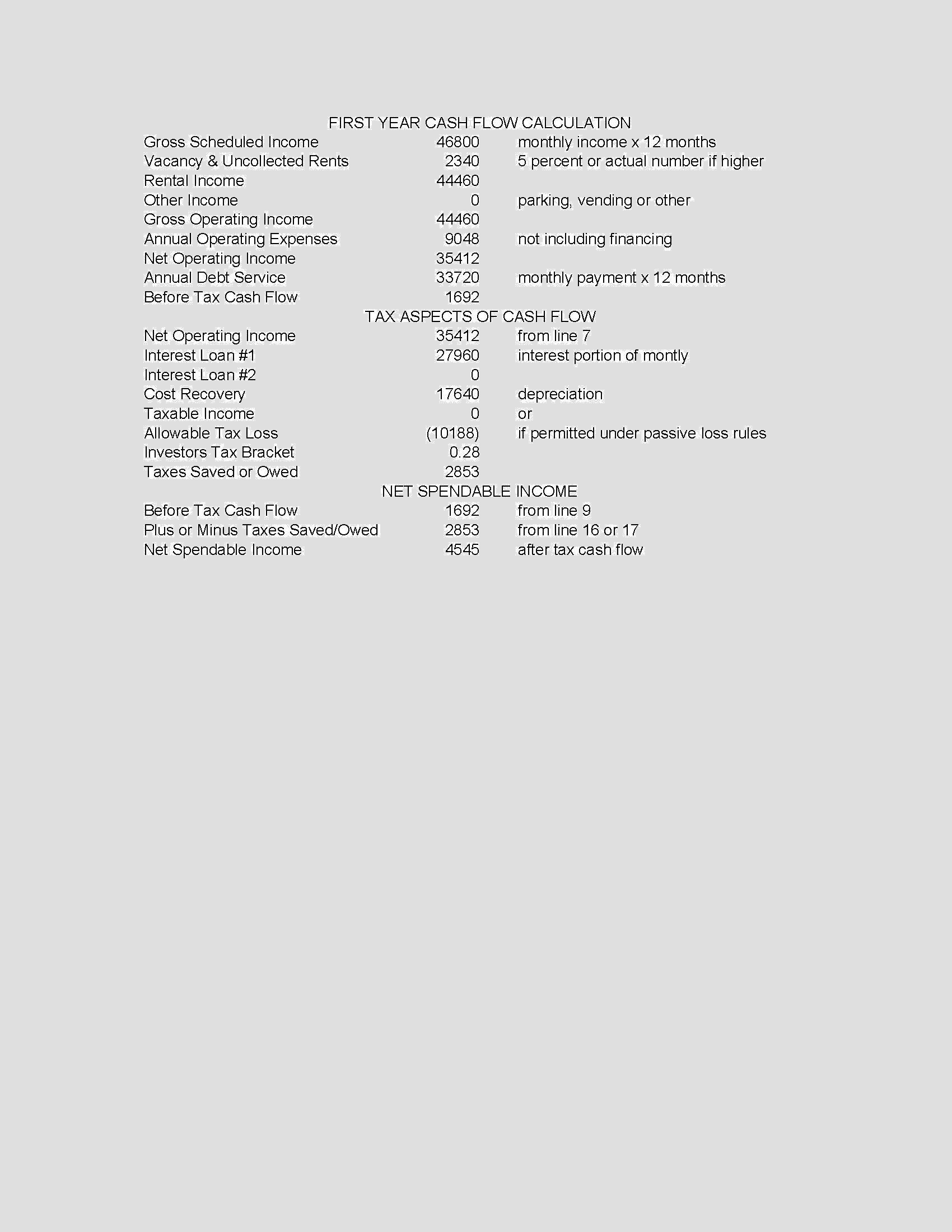

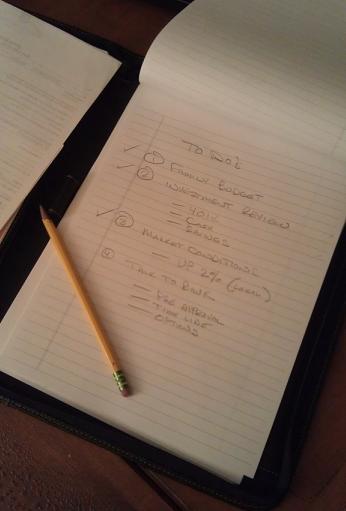

while having no bearing on the thinking of the investor class: My neighbors are really nice. The kids love to plant flowers here at the front door. This deck has great views. Nothing better than sitting here on Sunday morning having a cup of coffee. Should we clean out the garage? 20 minutes of solid number crunching will give any well-versed investor the answer to whether the property under consideration is worth the effort to pursue. Advantageous locations with supporting social amenities, acquisition cost and return on investment (ROI) are the focus. No “wow, I love this place”. No “I wonder if the neighbors kids will play well with mine”. And no coffee on the deck, just the numbers.

20 minutes of solid number crunching will give any well-versed investor the answer to whether the property under consideration is worth the effort to pursue. Advantageous locations with supporting social amenities, acquisition cost and return on investment (ROI) are the focus. No “wow, I love this place”. No “I wonder if the neighbors kids will play well with mine”. And no coffee on the deck, just the numbers.

If a deal doesn’t make any sense, move on. No name calling, no wasted time or energy. No friend or foe, just business.

If a deal doesn’t make any sense, move on. No name calling, no wasted time or energy. No friend or foe, just business.